GFG Expands Aljo Gold System 150 m East with Step-Out Results of 7.23 g/t Au over 2.0 m as Discovery-Driven Exploration Advances Across Goldarm

SASKATOON, Saskatchewan, Feb. 10, 2026 (GLOBE NEWSWIRE) -- GFG Resources Inc. (TSXV: GFG | OTCQB: GFGSF) (“GFG” or the “Company”) reports results from the final two drill holes completed as part of its 12-hole (2,650-metre) Phase 2-2025 drill program at the Aljo Gold Project (“Aljo”), located on the Company’s Goldarm Property (“Goldarm”) in the prolific Timmins Gold District of Ontario, Canada (see Figures 1 – 3 and Table 1).

Holes ALJ-25-037 and ALJ-25-038 were 125-150 metre (“m”) step-out holes to the east of the historic Aljo Gold Mine and confirm that gold mineralization extends well beyond the known limits of the mine workings. These results materially expand the footprint of the Aljo gold system and further demonstrate its scale, continuity, and growth potential.

Highlights:

-

First high-grade intercepts east of the diabase dyke in the Hangingwall (“HW”) Zone

- 1.23 grams of gold per tonne (“g/t Au”) over 16.0 m, including 7.23 g/t Au over 2.0 m (ALJ-25-037)

-

Main Zone successfully extended east of historical mine workings

- Multiple near-surface and stacked gold intercepts, including 2.23 g/t Au over 5.3 m, including 13.30 g/t Au over 0.5 m (ALJ-25-038)

- Strong grade and structural continuity confirmed within a broad mineralized envelope extending 125–150 m east of historic mine

- Phase 2 drill results support down-dip and strike expansion and validate future larger step-out drilling

-

Aggressive 6,000 m follow-up drill program planned with drilling to resume in H1-2026

Brian Skanderbeg, President and CEO of GFG stated, “These eastern step-out results are a clear validation of our strategy at Aljo. Multiple holes have now returned high-grade gold at shallow depths well beyond the historical mine workings, demonstrating strong potential to grow both the Main and HW Zones to the east. When combined with our recent bulk-tonnage intercepts, historical and recent high-grade results, and successful step-outs to the west, Aljo continues to show continuity and expansion potential in multiple directions. With over 6,000 m of drilling planned in 2026 and preliminary metallurgical testing advancing, we believe Aljo is well positioned to continue evolving toward a significantly larger gold system. Importantly, our strong balance sheet provides the flexibility to aggressively advance Aljo while simultaneously funding district-scale exploration across our Goldarm portfolio.”

Phase 2-2025 Program Overview

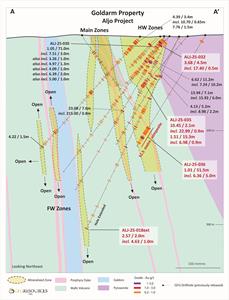

The Phase 2-2025 drill program at Aljo was designed to confirm and expand gold mineralization across the Main, HW, and Footwall (“FW”) Zones. Infill and step-out drilling in the Main and HW Zones confirmed continuity, expanded mineralization at depth, and refined the geological model. Drilling in the FW Zones successfully extended the FW3 Zone up-dip and led to the discovery of a new FW Zone, FW4 (see press releases dated November 27, 2025 and January 21, 2026).

The program also included large step-out drilling to the east across a north–south-oriented diabase dyke to test potential extensions of the Aljo Gold System beyond historical mining limits.

New Drill Results – Large Eastern Step-Outs

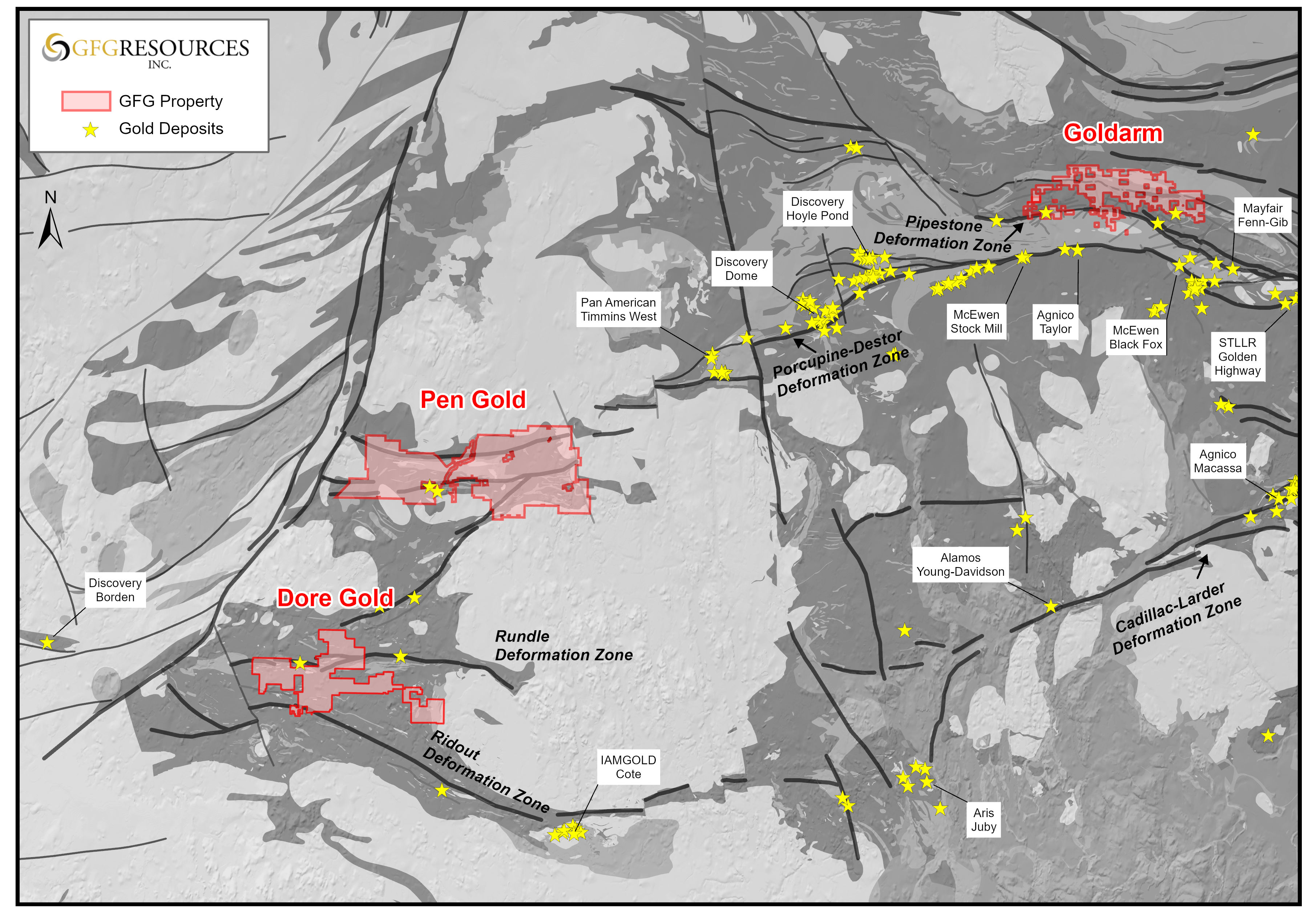

ALJ-25-037 – East HW Zone Extension

Hole ALJ-25-037 was drilled as a 150 m step-out east across the diabase dyke and is the first hole at Aljo to return significant high-grade gold mineralization in the HW Zone east of the dyke. The hole was collared in HW ultramafic rocks and intersected the mafic volcanic contact at 86 m downhole.

The East HW Zone was intersected at 132 m downhole, returning 1.23 g/t Au over 16.0 m, including a higher-grade core of 7.23 g/t Au over 2.0 m. Mineralization consists of north-east-striking, sulphide-bearing quartz-carbonate veins and veinlets hosted within pillowed, amygdaloidal mafic volcanic flows and associated breccias, proximal to intermediate porphyry dykes.

Additional mineralized intervals were encountered further downhole, including 2.4 g/t Au over 1.8 m, which includes 5.00 g/t Au over 0.8 m from 170.9 m. These zones are hosted in similar mafic volcanic rocks and remain closely associated with porphyry intrusions.

ALJ-25-038 – East Main Zone Extension

Hole ALJ-25-038 represents a 125 m step-out east across the diabase dyke and tested the Main Zone for the first time east of the historical mine workings. Gold mineralization was intersected near surface beginning at 5.2 m downhole, with multiple stacked intervals returned, including:

- 1.28 g/t Au over 7.1 m from 65.2 m

- 3.21 g/t Au over 2.4 m from 93.8 m

-

2.23 g/t Au over 5.3 m, including 13.30 g/t Au over 0.5 m, from 123.0 m

Mineralization comprises sheeted, north-east-striking, sulphide-bearing quartz-carbonate veins and veinlets hosted in altered, mafic volcanic flows. These intercepts correlate strongly with high-grade, visible-gold-bearing Main Zone mineralization encountered approximately 125 m to the west.

System Growth and Scale

Collectively, results from ALJ-25-037 and ALJ-25-038 demonstrate strong grade and structural continuity 125–150 m east of the historic Aljo Gold Mine. When combined with previously reported results, including 1.01 g/t Au over 51.5 m, including 6.36 g/t Au over 5.0 m in ALJ-25-036 (see press release dated January 21, 2026), the Aljo gold system is now significantly expanded both down-dip and along strike (see Figure 4).

These results confirm that larger step-out drilling is successfully extending the system, highlighting scale that was not historically recognized and reinforcing Aljo’s potential to evolve toward a robust resource-scale gold system.

Previously Announced Phase 2-2025 Highlights

- Broad and near-surface HW intercepts, including:

- 1.05 g/t Au over 71.0 m from 11.5 m, including visible gold and 7.51 g/t Au over 3.0 m, in ALJ-25-030

- 1.46 g/t Au over 14.3 m, including 9.36 g/t Au over 1.0 m, with visible gold, in ALJ-25-029

- Expanded FW system, including:

- FW3 Zone: 1.15 g/t Au over 6.5 m in ALJ-25-029

- New FW4 Zone: 4.22 g/t Au over 1.5 m in ALJ-25-029

- High-grade and broad HW intercepts, including:

- ALJ-25-036: 1.01 g/t Au over 51.5 m, including 6.36 g/t Au over 5.0 m

- ALJ-25-035: 10.45 g/t Au over 2.1 m, including 22.90 g/t Au over 0.9 m, with visible gold

- Infill drilling confirms continuity in both HW and Main Zones with visible gold locally

Anders Carlson, Vice President of Exploration at GFG commented, “What’s particularly encouraging about these eastern step-outs is that we’re seeing all the right geological ingredients for continued growth—porphyry dyking, broad gold anomalism, favourable host rocks, and well-developed vein sets—mirroring the controls on mineralization closer to the mine. The system remains open along strike and at depth, and future drilling will focus on expanding the Main and HW Zones east and west, while continuing to grow the FW corridor. At the same time, we are aggressively advancing our regional exploration strategy at Goldarm, with a 90-hole sonic base-of-till program and a 2,500 m first-pass diamond drilling campaign targeting priority corridors along the Pipestone Deformation Zone. These programs are well advanced, scheduled for completion in Q1, and represent the final stage of earn-in expenditures on the WWCC Property, which is part of Goldarm, positioning GFG for both near-term growth at Aljo and new discovery upside across the district.”

Next Steps – 2026 Exploration Program

GFG is well-financed and positioned to execute an aggressive, multi-pronged exploration program in 2026, designed to both advance Aljo toward resource-scale definition and unlock new discoveries across the broader Goldarm and Pen properties.

Aljo Gold Project – Resource Growth Focus

At Aljo, drilling will continue to focus on systematic infill and step-out drilling across the HW, Main, and FW Zones, with priority placed on expanding mineralization along strike and at depth. Emphasis will be placed on the HW Zone below historical mine workings and the emerging FW corridor, where recent drilling has outlined new zones of gold mineralization. Continued eastern and western step-outs will aim to further expand the overall footprint of the Aljo gold system.

Goldarm Property – District-Scale Discovery Engine

In parallel, GFG is advancing a district-scale regional exploration program across priority corridors on the Goldarm Property. A 90-hole sonic drilling program, of which 45 holes have been completed to date, targeting base-of-till (“BOT”) and top-of-bedrock sampling along the approximately 15 km Pipestone Fault corridor commenced in late 2025, forming the foundation of a multi-year regional exploration strategy. This program is complemented by diamond drilling of high-priority regional targets generated through integrated geological, structural, and geophysical analysis.

Pen Property – Target Advancement

At the Pen Property west of Timmins, GFG continues to refine and prioritize regional targets based on encouraging drilling, newly acquired IP data, and extensive BOT sampling. Highly anomalous gold-grain counts and pathfinder mineral associations define fertile structural corridors slated for drill testing in 2026.

Strategic Outlook

GFG’s 2026 exploration strategy reflects a clear commitment to deploying capital into the ground, leveraging its district-scale land position, and advancing multiple discovery opportunities across one of Canada’s most prolific and infrastructure-rich gold camps. Continued growth drilling at Aljo, combined with systematic regional exploration across Goldarm and Pen, positions the Company for a catalyst-rich year ahead with meaningful discovery and growth potential.

Table 1: Summary of Phase 2-2025 Aljo Gold Project Assay Results (1)

| Hole ID | From (m) | To (m) | Length (m) | Au (g/t) | Zone | Visible Gold | |||||

| ALJ-25-037 | 132.0 | 148.0 | 16.0 | 1.23 | East HW | ||||||

| incl. | 142.0 | 144.0 | 2.0 | 7.23 | East HW | ||||||

| and | 156.2 | 158.2 | 2.0 | 1.07 | East HW | ||||||

| and | 170.9 | 172.7 | 1.8 | 2.40 | East HW | ||||||

| incl. | 171.9 | 172.7 | 0.8 | 5.00 | East HW | ||||||

| ALJ-25-038 | 5.2 | 8.2 | 3.0 | 1.15 | East Main | ||||||

| and | 65.2 | 72.3 | 7.1 | 1.28 | East Main | ||||||

| and | 93.8 | 96.2 | 2.4 | 3.21 | East Main | ||||||

| and | 123.0 | 128.3 | 5.3 | 2.23 | East Main | ||||||

| incl. | 124.9 | 125.4 | 0.5 | 13.30 | East Main | ||||||

| Previously Released 2025 Phase 2 Assays | |||||||||||

| ALJ-25-029 | 7.7 | 22.0 | 14.3 | 1.46 | HW | ✓ | |||||

| incl. | 19.5 | 20.5 | 1.0 | 9.36 | HW | ✓ | |||||

| and | 30.5 | 45.0 | 14.5 | 0.58 | HW | ✓ | |||||

| and | 50.5 | 58.8 | 8.3 | 0.52 | HW | ||||||

| and | 127.8 | 128.8 | 1.0 | 2.74 | Main | ||||||

| and | 131.5 | 132.2 | 0.7 | 6.65 | Main | ||||||

| and | 190.0 | 199.0 | 9.0 | 1.15 | Main | ||||||

| incl. | 197.0 | 198.0 | 1.0 | 3.55 | Main | ||||||

| and | 335.0 | 341.5 | 6.5 | 1.15 | FW3 | ||||||

| incl. | 339.3 | 340.0 | 0.7 | 4.13 | FW3 | ||||||

| and | 389.0 | 390.5 | 1.5 | 4.22 | FW4 | ||||||

| ALJ-25-030 | 11.5 | 82.5 | 71.0 | 1.05 | HW | ✓ | |||||

| incl. | 15.5 | 18.5 | 3.0 | 7.51 | HW | ✓ | |||||

| also incl. | 26.0 | 27.0 | 1.0 | 3.26 | HW | ||||||

| also incl. | 31.5 | 32.8 | 1.3 | 4.97 | HW | ||||||

| also incl. | 46.5 | 47.5 | 1.0 | 4.09 | HW | ||||||

| also incl. | 70.5 | 72.5 | 2.0 | 6.39 | HW | ✓ | |||||

| also incl. | 77.5 | 78.5 | 1.0 | 5.00 | HW | ||||||

| and | 97.5 | 99.0 | 1.5 | 2.83 | HW | ||||||

| and | 113.4 | 114.5 | 1.1 | 1.01 | HW | ||||||

| and | 176.0 | 177.0 | 1.0 | 1.00 | Main | ||||||

| and | 209.5 | 212.0 | 2.5 | 1.28 | Main | ||||||

| and | 224.0 | 225.0 | 1.0 | 1.88 | Main | ||||||

| ALJ-25-018ext | 568.0 | 570.0 | 2.0 | 2.57 | FW | ||||||

| incl. | 569.0 | 570.0 | 1.0 | 4.63 | FW | ||||||

| ALJ-25-031 | 124.8 | 126.3 | 1.5 | 1.18 | HW | ||||||

| and | 133.1 | 134.6 | 1.5 | 4.67 | HW | ||||||

| and | 251.9 | 252.7 | 0.8 | 1.97 | Main | ||||||

| and | 268.9 | 270.4 | 1.5 | 2.51 | Main | ||||||

| and | 297.6 | 298.1 | 0.5 | 1.27 | Main | ||||||

| and | 325.6 | 326.4 | 0.8 | 11.40 | Main | ||||||

| ALJ-25-032 | 29.5 | 34.0 | 4.5 | 3.68 | HW | ✓ | |||||

| incl. | 29.5 | 30.0 | 0.5 | 17.40 | HW | ✓ | |||||

| and | 89.3 | 92.0 | 2.7 | 2.80 | HW | ||||||

| and | 130.0 | 131.0 | 1.0 | 2.86 | Main | ||||||

| and | 146.9 | 147.7 | 0.8 | 4.92 | Main | ✓ | |||||

| and | 167.0 | 168.0 | 1.0 | 1.40 | Main | ||||||

| ALJ-25-033 | 25.2 | 31.0 | 5.8 | 2.03 | HW | ✓ | |||||

| incl. | 27.2 | 27.7 | 0.5 | 10.40 | HW | ✓ | |||||

| ALJ-25-034 | 62.4 | 63.6 | 1.2 | 1.27 | HW | ||||||

| and | 74.0 | 75.0 | 1.0 | 1.08 | HW | ||||||

| ALJ-25-035 | 147.3 | 150.4 | 3.1 | 0.98 | HW | ||||||

| and | 159.9 | 162.0 | 2.1 | 10.45 | HW | ✓ | |||||

| incl. | 159.9 | 160.9 | 0.9 | 22.90 | HW | ✓ | |||||

| and | 171.2 | 186.5 | 15.3 | 1.51 | HW | ✓ | |||||

| incl. | 175.0 | 175.9 | 0.9 | 6.98 | HW | ✓ | |||||

| ALJ-25-036(3) | 291.3 | 342.8 | 51.5 | 1.01 | HW | ||||||

| incl. | 321.0 | 326.0 | 5.0 | 6.36 | HW | ||||||

(1)Drill intercepts are presented using a 0.20 g/t Au cut-off and as drilled length with a minimum 1 gram-metre product. Composites include internal dilution of up to 3 m at grades less than 0.20 g/t Au. Included intervals are calculated using a 3 g/t cut-off at a minimum 1 gram-metre product unless otherwise stated. True width is estimated to be 30 to 90% drilled length.

(2) Includes a single 8.5 metre interval below 0.2 g/t Au cut-off

(3) Includes a single 5 metre interval below 0.2 g/t Au cut-off.

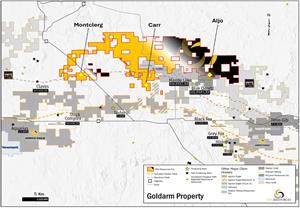

Figure 1: Regional Map of GFG Gold Projects in the Timmins Gold District

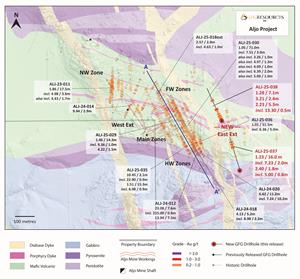

Figure 2: Goldarm Property Plan View Map

Figure 3: Aljo Gold Project Plan View Map(1)

Figure 4: Aljo Gold Project Cross Section(1)

About the Aljo Gold Project

The Aljo Gold Project lies within GFG’s Goldarm Property, located in the world-class Timmins Gold District of northeastern Ontario. The project is situated near the Porcupine-Destor Deformation Zone, includes historical underground workings, and is proximal to mills, roads, and power infrastructure providing excellent potential for discovery and future development in a tier-one mining jurisdiction.

About GFG Resources Inc.

GFG is a North American precious metals exploration company focused on district scale gold projects in tier one mining jurisdictions. The Company operates three gold projects, each hosting large and highly prospective gold properties within the prolific gold district of Timmins, Ontario, Canada. The projects have similar geological settings that host most of the gold deposits found in the Timmins Gold Camp which have produced over 70 million ounces of gold.

For further information, please contact:

Brian Skanderbeg, President & CEO

or

Marc Lepage, Vice President, Business Development

Phone: (306) 931-0930

Email: info@gfgresources.com

Website: www.gfgresources.com

Stay Connected with Us

X (Twitter): GFGResources

LinkedIn: https://www.linkedin.com/company/gfgresources/

Facebook: https://www.facebook.com/GFGResourcesInc/

Footnotes:

(1) Drill intercepts are presented using a 0.2 g/t Au cut-off and as drilled length. Composites include internal dilution of up to 3 m at grades less than 0.2 g/t Au. Included intervals are calculated using a 3 g/t cut-off at a minimum 1 gram-metre product unless otherwise stated. True width is estimated to be 30 to 90% of drilled length. Sampling protocols, quality control and assurance measures and geochemical results related to historic drill core samples quoted in this news release have not been verified by the Qualified Person and therefore must be regarded as estimates.

(2) Includes a single 8.5 metre interval below 0.2 g/t Au cut-off.

(3) Includes a single 5 metre interval below 0.2 g/t Au cut-off.

(4) Historic assays have not been reviewed by the QP and should not be relied upon. Historical references reported herein are based on the following reports:

Nahanni: Historical drill intercepts are referenced from the 1981 Nahanni Mines Ltd. assessment report #42A10NE0022.

Carr: Historical drill intercepts are referenced from the 1995 Pentland Firth Ventures Ltd. assessment report #42A09SW0170.

McCristie: Historical drill intercepts and showings referenced from the 1983 N. McCristie assessment report #42A09NW0131.

Fournier: Historical drill intercepts and showings referenced from the 1987 E. Fournier assessment report #42A09NW0111.

Sampling and Quality Control

All scientific and technical information contained in this press release has been prepared under the supervision of Anders Carlson, P.Geo. and Vice President, Exploration of GFG, a qualified person within the meaning of National Instrument 43-101.

Drill core samples are being analyzed for gold by Activation Laboratories Ltd. in Timmins, Ontario. Gold analysis consists of the preparation of a 500-gram pulp and an assay of a 50-gram aliquot by Pb collection fire assay with an Atomic Absorption Spectrometry finish (Package 1A2-50. Samples assaying above 5 ppm Au are routinely re-run using a gravimetric finish (Package 1A3-50). Selected samples are analysed by metallic screen method (Package 1A4) using a 100-mesh to better determine the size of gold grains in the system. Selected samples are also undergoing multi-element analysis for 59 other elements using a four-acid digestion and an ICP-MS finish (Package MA250) by Bureau Veritas Commodities Canada Ltd. in Vancouver, British Columbia. Quality control and assurance measures include the monitoring of results for inserted certified reference materials, coarse blanks and preparation duplicates of drill core.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

All statements, other than statements of historical fact, contained in this news release constitute “forward-looking information” within the meaning of applicable Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (referred to herein as “forward-looking statements”). Forward-looking statements include, but are not limited to, the Company’s future exploration plans with respect to its property interests and the timing thereof, the prospective nature of the projects, future price of gold, success of exploration activities and metallurgical test work, permitting time lines, currency exchange rate fluctuations, requirements for additional capital, government regulation of exploration work, environmental risks, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes”, or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results, “may”, “could”, “would”, “will”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

All forward-looking statements are based on various assumptions, including, without limitation, the expectations and beliefs of management, the assumed long-term price of gold, that the Company will receive required permits and access to surface rights, that the Company can access financing, appropriate equipment and sufficient labour, and that the political environment within Canada will continue to support the development of mining projects. In addition, the similarity or proximity of other gold deposits to the Company’s projects is not necessary indicative of the geological setting, alteration and mineralization of the Goldarm Property, the Pen Gold Project and the Dore Gold Project.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of GFG to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: actual results of current exploration activities; environmental risks; future prices of gold; operating risks; accidents, labour issues and other risks of the mining industry; availability of capital, delays in obtaining government approvals or financing; and other risks and uncertainties. These risks and uncertainties and the additional risks described in the Company’s most recently filed annual and interim MD&A are not and should not be construed as being exhaustive.

Although GFG has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. In addition, forward-looking statements are provided solely for the purpose of providing information about management’s current expectations and plans and allowing investors and others to get a better understanding of our operating environment. Accordingly, readers should not place undue reliance on forward-looking statements.

Forward-looking statements in this news release are made as of the date hereof and GFG assumes no obligation to update any forward-looking statements, except as required by applicable laws.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/09c8a5d2-39c5-4f06-9575-193994d72f83

https://www.globenewswire.com/NewsRoom/AttachmentNg/bedc0ef5-9882-4140-916a-e290e9e55dd1

https://www.globenewswire.com/NewsRoom/AttachmentNg/264a4f99-8d80-4ded-8407-a232763fb118

https://www.globenewswire.com/NewsRoom/AttachmentNg/dc685fc0-c32b-4bc1-bb1b-b4c0c55be8a4

Figure 1: Regional Map of GFG Gold Projects in the Timmins Gold District

GFG Resources Inc. Gold Projects in the Timmins Gold District

Figure 2: Goldarm Property Plan View Map

GFG Resources Inc. Goldarm Property Plan in View Map

Figure 3: Aljo Gold Project Plan View Map

GFG Resources Inc. - Aljo Gold Project in Plan View Map

Figure 4: Aljo Gold Project Cross Section

GFG Resources Inc. Aljo Gold Project in Cross Section

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.